Look like somethings is rotten in either the economy banking sector or both. Look is like we may be due for another wave of bank failures and possibly an official recession call. It's going to be an interesting year

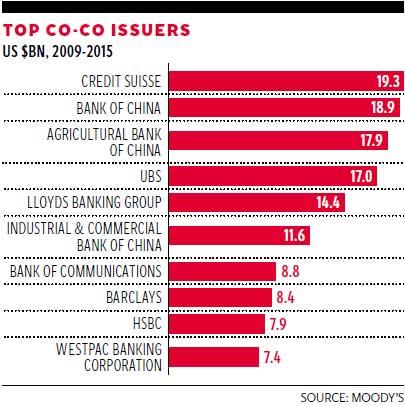

"Living wills" of 5 banks fail to pass muster Congress demanded that big banks regularly provide regulators with careful plans, also known as living wills, for how they would enter bankruptcy in an orderly fashion. But the Federal Reserve and the Federal Deposit Insurance Corporation found that the plans of five banks were “not credible” or “would not facilitate an orderly resolution” under the United States bankruptcy code. mk and I are wagering that the straw that breaks the camel's back is going to be European CoCo bonds, which will spread contagion throughout finance. From a selfish American standpoint it's likely to smash the shit out of Europe with any damage in the US being largely collateral; the author of your article rips into US regulation more than a little bit but the financial crisis of 2008 left the US in a better position, regulation-wise, than the EU. mk found an article yesterday - maybe he'll link to it, in which Deutsche Bank basically said "yup - all that garbage we have on our books is going to cause an absolute catastrophe if we don't get rid of it in 12-18 months" and both he and I wagered that they'd just added a year to their projections, based on the way DB has been acting. Last time we had a meltdown the blogs were talking about meltdowns with dreary regularity for about 18 months prior to it happening. Fatigue had basically set in where everyone couldn't quite believe we were still coasting. Then one fine week in September it just ripped. A quarter of Europe's capitalization is in CoCos, and half of the interest in the S&P500 is short. When this thing goes it's going to be dramatic.Five giant banks — including JPMorgan Chase and Bank of America — failed to fulfill a crucial regulatory requirement that Congress introduced after the 2008 financial crisis to help make large financial institutions less of a threat to the wider economy, federal banking regulators said on Wednesday.

If you get into a job and start before it all blows up you will be ok or at least your odds are better. If you graduate after... Well I hope you get along with your parents... Cuz yeah... Things didn't work out all that great for the last group to graduate into a recession.

Frankly, I think we're all fucked in weeks not months based on the frequency of oh-shit mumblings. Which means you'll be in college when the shit hits the fan. mk is a straight-up bitbug. He thinks that shit's gonna go through the roof. I hope he's right but I have little confidence in the rational cause:effect nature of markets. Kinda like how the news on BTC was all bad this weekend and the news on ETH was all good and ETH still took a giant shit.

I think you are probably early in your prediction. Things were starting to look bad in the summer of 07. Summer of 08 we has wonky instability and even when we had bear sterns, it took another couple months for the market to figure out how bad things were. We have a couple major turds in the hopper that are getting ready to hit the fan but they haven't really exploded or shown up on balance sheets. Fracker defaults have been mostly contained so far and banks haven't taken large losses. Auto subprime is just starting to gain traction and zombies corporations haven't started to default yet.

To you and to veen's point. We have a fuck-ton of student debt which is already largely not being paid. Okay. The economy tanks (globally - but what about in the US?) and suddenly you have even more recent graduates with no way of making payments and no end in sight. Defer the payments, be under-employed or not employed at all, and have years of not actually paying back those loans. Does that bubble then pop, too?Frankly, I think we're all fucked in weeks not months based on the frequency of oh-shit mumblings. Which means you'll be in college when the shit hits the fan.

Right? mk and I were discussing what the next bailout looks like when interest rates are already effectively zero. I think that depending on who's in office, a student loan debt jubilee (probably not total, but certainly partial) would probably be the easiest, most effective stimulus to pass. Most student loans are government-originated and even the private ones have a government component.

There won't be student loan forgiveness just don't see it. It would go against America capitalist values. Bankruptcy allowance maybe but forgiveness no. The next bailout is already happening you just missed the announcement. The current fed rate of 25 to 50 bps in a Negative rate environment is a stealth bank bailout. The fed is paying banks more than the maket rate to hold money and effectively subsidies the banks.

Interestingly enough from a global financial stability point of view I actually like Co-Co bonds. Sure they are a shit investment for the individual investors but they are structured in a way that is very favorable to banks. If the capital ratio drops too much the bond obligations basically disappear and they get converted to common stock automatically and help recapitalize the bank. Its almost like a self bail out mechanism. Nobody wants to be the first to trigger them but once the first couple banks trigger the clause everyone else will pile in and use them to recapitalize. Now as with all things finance there could be contagion, and all sorts of unintended consequences but overall I actually think Co-Cos are not all that bad (for financial stability).

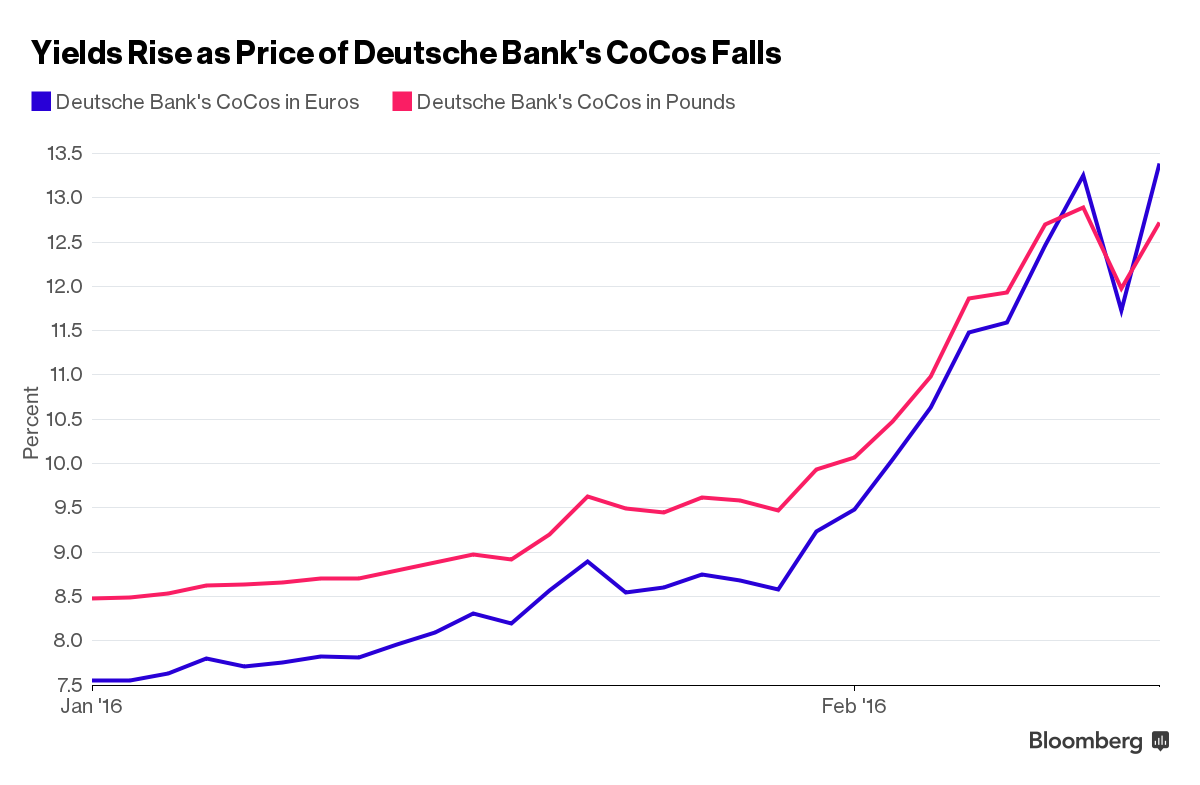

Except that they offer a deal so good for the banks that the rates they have to pay are f'n ruinous: Which, in a NIRP-world, provides quite a lot of drag on liquidity. If you're giving bond-holders f'n 16 percent while your intrabank rate is like -1 percent your costs of doing business are sucking. I'm no fan of banks but to my understanding, CoCos are the equivalent of a Providian credit card: things are great until they aren't, and then all of a sudden you are in.the.shit. Commence the debt spiral. The shit. I see it. It's over there. And we keep walking closer.

Well the way bonds work is that as the company you only pay the issue rate (which was probably generous 6-8% but not that crazy 16%). The market yield is set by the discounting of the underlying asset. Obviously you shouldn't really issue more because it would be very costly but even then issuing more cocos should theoretically not affect your capitalization ratio because once you hit that magic threshold all the Co-Co bonds turn into equity shares with no underlying obligations.

True enough, and a good clarification. However, it points to a bigger problem - if you, the buyer, are getting 6-8% for loaning DB money and I, the secondary market want 16% to take that bond off your hands, you're not making money. More than that, DB has a helluva time continuing to sell CoCos. From my understanding, CoCos amplify risk an outsized amount compared to their value because they have that magic "DB hits 12 poof you own stock" aspect. Worse than that, DB doesn't have to count the stock that goes poof until it goes poof, which means it also dilutes the fuck out of shares when it blows up. So it's not just that they're risky, it's that they externalize that risk to everyone else that holds DB, whether or not they own CoCos. There's a built in "cascade of bullshit" with convertibles in general but it's been held in check somewhat by the fact that the conversion is usually a litigation point. With CoCos that conversion point is writ in stone, which makes it rip quick and relentless. Finally, these are bonds that are being traded at 16% in an environment where nothing trades at 16%. Every trader I follow has been bitching about yields and how boring the market is these days and I think you, yourself pointed out that the problem with addiction to high-yield financing is that when the yield drops the cost of business spikes (can't find the comment, though). So the guys that are buying into CoCos aren't doing it on a lark, they're doing it because they've been painted into a corner by an environment where it's a stone bitch to make money. And now poof they're shareholders. In a failing asset. That they sure as fuck wouldn't have bought back when it was healthy; not without those 16% yields, anyway. And when the bonds convert, and the stock dilutes, and the share price has already been plummeting, it's gonna get messy on more than the guys holding the CoCos. It's gonna get messy on the guys that know the guys that know the guys that do business with the guys that hold the CoCos.

I agree with you that CoCos are bad for the buyer. But not necessarily for the issuer. The interesting question is who is the holder for these, and if I had to take a guess its likely going to be the dumbest money in the room (pension funds). They need the 8% yields to keep their balance sheets from ballooning out of control they they have been on a buying spree for all sorts of garbage like this and sub-prime auto loan. In the end, you and I will eventually have to pay for all the looses though increased city and state taxes. I'd be willing to wager that CoCos are not going to be the prime reason for the next big recession. The only way I can see them doing real damage to the financial institutions is if UBS owns DB cocos or vice versa. Then everyone is at risk for systematic failure.

This will happen after the shit has hit the fan. We learned this last time: there is no political capital to be made in explaining catastrophic banking instruments to the general public until after they have laid waste to the economy. THEN you blame Janet Yellen and the Fed for ZIRP (regardless of the fact that it's a free-market fantasy from the get-go). Great thing about Dodd-Frank is everybody hates it - the liberals because it doesn't do enough, the conservatives because it doesn't do enough. So that football is gonna get hiked like it's the Superbowl regardless of what happens - so long as something happens. I think something is going to happen.

mk link it and tag me. Serious. Hubski makes me look great at my job sometimes, cuz I show up talking about negative interest rates and people are like "Wow I don't even consider what's going on in international banking" and i'm like "DUDES BUT THIS IS THE MOST INTERESTING THING!"

The link mk was all psyched and shit because the technical analysis (AKA entrail scrivening) of the S&P vs. Barclay's and DB matched his own. When I looked at his analysis I was unconvinced it wasn't due to selective windowing. Not saying there isn't a correlation, just saying that I'm not a firm believer in causation. From the article: Yield curve be flat. Junk bonds be shit. Alls we needs is that wonderful "external shock." Hey, how 'bout: As the price of oil plunged below $30 in January and February, investors rushed to sell debt issued by companies that needed expensive oil to stay profitable. Saudi oil minister says fuck yer oil cuts, also Iran isn't going to the summit Not saying this will be it - but oil jumped to its 2016 peak yesterday over the announcement that the Saudis would be making a deal. Wanna see what an existential economic struggle looks like? So the question is: if the European economy is dependent on Saudi Arabia toeing the line, and if Saudi Arabia is the country that brought you UBL and 16 of the 18 9/11 hijackers, how likely is it that at some point soon, the European economy is in for, well, not a nasty surprise, but a nasty eventuality?This analysis suggests we need the combination of three conditions for us to be confident the next default cycle is around the corner. We need the accumulation of excessive debt and preferably of deteriorating quality, some kind of external shock/trigger and a sharp flattening of the yield curve.

Of particular concern was the market for high-yield (or junk) bonds issued by oil and gas companies.

"Forget about this topic," he told the paper, when asked about any possible reduction in his country's production.